We're a 2020 Best Value, with a No. 5 ranking on College Factual's list of Best Accounting Colleges for the Money in New York.

Through a combination of innovative coursework that balances analytical thinking and creativity, one-to-one interaction with faculty, attractive internships, and an opportunity to earn your BBA in accounting and your MBA in professional accountancy in five years or less, SBU accounting graduates are well-equipped to achieve professional success.

Demand for accountants is a steady climb, faster than the average for all occupations, according to the Bureau of Labor Statistics. That means there will be job for you when you graduate.

98% of our students have a job offer before they graduate.

A minor in accounting

For non-majors, a minor in accounting provides a solid grounding for anyone planning to work in the banking or financial industry, and can help increase your understanding of how financial theories are used and applied.

Requirements for a minor in accounting

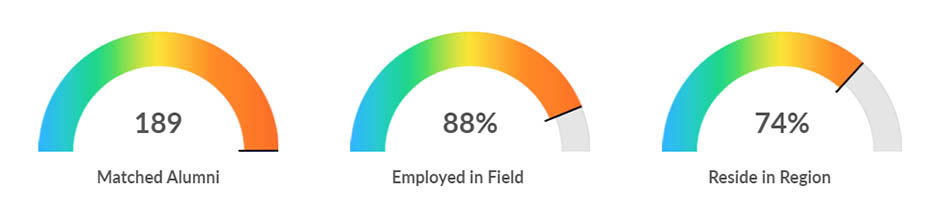

Source: Emsi Data

Source: Emsi Data

Data collected from 189 SBU accounting graduates between 2008-2020 shows that 89% are employed in the field, and nearly 75% live and work in WNY.

Outcomes & placement rates

Accounting is as much about communication as it is numbers. With your BBA in accounting from SBU you will be prepared with the necessary skills to analyze complex business challenges and clearly communicate solutions for success.

In other words, you'll be more than ready to step into your first job in accounting.

Learn more at

Outcomes & Placement Rates